Real Estate Capital Investments in New York: Your Overview to Generating Passive Earnings

Realty capital investments have long been a dependable means to build wealth and produce easy revenue. In a vibrant market fresh York, possibilities abound for savvy capitalists to secure buildings that create regular cash flow. From bustling urban centers to suburban retreats, New york city offers varied property alternatives to fit numerous financial investment approaches. Below's your guide to understanding and making best use of realty cash flow financial investments in New York.

What Are Real Estate Capital Investments?

Capital investments in property describe residential properties that produce revenue exceeding the expenses of possession, such as home loan repayments, maintenance, taxes, and insurance coverage. Positive capital gives a consistent income stream, making it an eye-catching method for long-term wide range structure.

In New York, capital residential or commercial properties can range from multi-family homes and single-family leasings to business properties and trip leasings. The trick is identifying places and residential property kinds that straighten with your monetary objectives.

Why Invest in New York City Realty for Capital?

High Rental Demand

New york city's varied populace and dynamic economy make sure regular need for rental buildings. Urban centers like New York City, suburban areas in Long Island, and picturesque upstate areas attract a large range of lessees, from specialists to pupils and visitors.

Solid Market Appreciation

While cash flow is the key emphasis, New york city residential or commercial properties typically gain from lasting admiration, including an additional layer of success to your investment.

Diverse Financial Investment Opportunities

New york city offers buildings across a broad spectrum, consisting of deluxe homes, multi-family devices, and business spaces, allowing investors to tailor their techniques based upon their know-how and spending plan.

Tourist and Seasonal Rentals

Areas like the Hudson Valley and the Adirondacks grow on tourist, making temporary and mid-term rental financial investments very financially rewarding.

Leading Areas for Capital Investments in New York City

New York City

The five boroughs-- Manhattan, Brooklyn, Queens, Bronx, and Staten Island-- use endless chances for cash flow investments. Multi-family homes and mixed-use residential or commercial properties in external districts are especially appealing for regular rental income.

Long Island

Rural Long Island supplies opportunities for single-family leasings and villa, specifically in areas like the Hamptons and North Fork.

Upstate New York

Regions like Albany, Saratoga Springs, and Buffalo have actually seen expanding need for cost effective housing, making them excellent spots for money flow-focused financial investments.

Hudson Valley

A hotspot for vacation rentals, the Hudson Valley draws in vacationers and lasting occupants alike. Properties here offer a mix of affordability and high returns.

Western New York

Cities like Rochester and Syracuse are known for their price and solid rental demand, making them excellent for investors looking for properties with lower purchase costs and higher returns.

Sorts Of Cash Flow Investment Residences

Multi-Family Houses

Multi-family properties, such as duplexes and apartment buildings, are among the best for consistent cash flow. The multiple units give varied revenue streams, minimizing https://sites.google.com/view/real-estate-develop-investment/ threat.

Single-Family Services

Single-family homes offer security and are much easier to manage. These are popular in suburban markets like Long Island and parts of upstate New York.

Holiday Leasings

High-tourism locations like the Adirondacks or the Hamptons can yield significant income via temporary rental platforms like Airbnb.

Industrial Properties

Retail rooms, office complex, and mixed-use homes in city areas can supply high yields, particularly in busy downtown.

Actions to Do Well in Realty Cash Flow Investments

Evaluate Prospective Cash Flow

Determine your residential or commercial property's expected revenue and subtract all expenses. This consists of car loan repayments, tax obligations, insurance, maintenance, and building administration charges. Positive cash flow is your goal.

Choose the Right Location

Research study rental need, vacancy rates, and typical rental income in your selected location. Opt for places with solid financial growth and tenant demand.

Safe Funding

Look for funding choices that line up with your financial investment goals. Low-interest loans or partnerships can optimize your roi (ROI).

Partner with Property Monitoring Services

Professional residential or commercial property administration firms can take care of lessee relations, maintenance, and rent collection, ensuring a smooth investment experience.

Leverage Tax Benefits

Realty investments provide tax benefits, such as devaluation and reductions for maintenance expenses, decreasing your taxable income.

Typical Challenges and How to Conquer Them

High Initial Costs

New York real estate is known for its high home worths, https://sites.google.com/view/real-estate-develop-investment/ specifically in city areas. Consider beginning with smaller buildings or buying emerging markets upstate.

Tenant Turnover

High tenant turn over can minimize capital. Screen renters completely and offer rewards for lasting leases to minimize this danger.

Regulative Difficulties

New york city has strict rental laws and laws. Acquaint on your own with regional ordinances or employ an experienced property lawyer to browse these complexities.

The Future of Real Estate Cash Flow Investments in New York https://sites.google.com/view/real-estate-develop-investment/ City

The demand for rental residential or commercial properties in New York remains solid, fueled by economic growth, populace variety, and tourism. Urban locations like New York City continue to see high need, while upstate areas supply economical access factors and promising returns.

As remote job patterns grow, rural and rural areas are seeing an increase of occupants, opening up brand-new chances for investors. Furthermore, sustainability-focused developments and modernized residential or commercial properties are drawing in greater rents, making them rewarding financial investments.

Realty capital investments in New York supply a trusted way to construct wealth and attain financial flexibility. By choosing the right area, building kind, and management technique, you can develop a constant earnings stream and appreciate lasting gratitude.

Whether you're a skilled capitalist or simply beginning, New york city's diverse market supplies opportunities to match your goals. With careful preparation and market evaluation, you can turn your real estate investments right into a prospering resource of easy earnings.

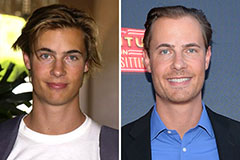

Erik von Detten Then & Now!

Erik von Detten Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!